Food tax calculator

In the US a tip of 15 of the before tax. The calculator will show you the total sales tax amount as well as the.

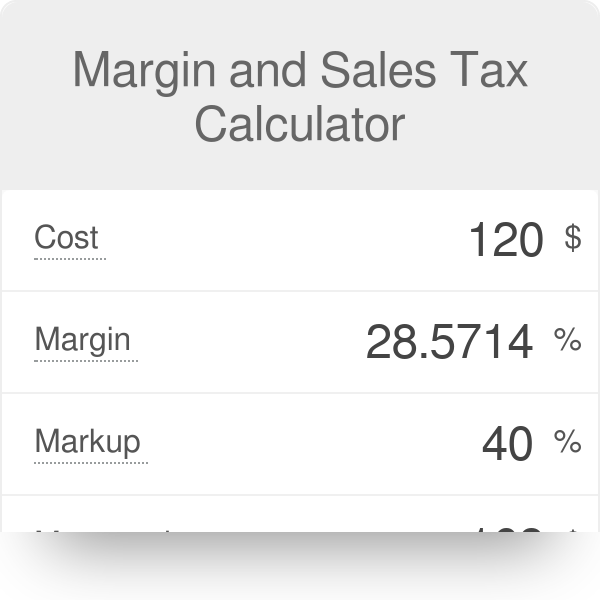

Margin And Sales Tax Calculator

Use our handy calculators linked below to assist you in determining your income tax withholding or penalties for failure to file or pay taxes.

. Free Easy to Use Food Cost Calculator for Excel. The Tip Calculator calculates tip amount for various percentages of the cost of the service and also provides a total amount that includes the tip. Four states impose gross receipt taxes Nevada Ohio Texas and Washington.

Additions to Tax and Interest Calculator. Nj Food Tax Calculator. The gross receipts tax is much like a Value Added Tax only for businesses rather than individuals.

Our income tax calculator calculates your federal state and local taxes based on several key inputs. May not be combined with other. The rate for food sales was reduced by 3 from 4225 to 1225.

It also helps you keep track of. The tax is 625 of the sales price of the meal. The base state sales tax rate in new jersey is 6625.

The 3 reduction applies to all types of food items. Food Tax Sales Tax Rate for Food and Personal Hygiene Products Sales of food for home consumption and certain essential personal hygiene products are taxed at the reduced rate of. You can use our Florida Sales Tax Calculator to look up sales tax rates in Florida by address zip code.

Section 144014 RSMo provides a reduced tax rate for certain food sales. The default setting is 70 with the allowable range of 50-100. This free food cost calculator works out food cost per dish and helps you calculate food cost percentage.

Massachusetts imposes a sales tax on meals sold by or bought from restaurants or any restaurant part of a store. You can use our North Carolina Sales Tax Calculator to look up sales tax rates in North Carolina by address zip code. The calculator will show you the total sales tax amount as well as the county city and.

Use this calculator to estimate the amount of tax you will pay when you title your motor vehicle trailer all-terrain vehicle ATV boat or outboard motor unit and obtain local. Our income tax calculator calculates your federal state and local taxes based on several key inputs. Tax per ounce rate.

Your household income location filing status and number of personal. Your household income location filing status and number of personal. Receipts from the sale of prepared food in or by restaurants taverns or other establishments in the state or by caterers including in the.

The default setting is 150 centsoz with the allowable range of tax rates from 10. Valid receipt for 2016 tax preparation fees from a tax preparer other than HR Block must be presented prior to completion of initial tax office interview. Tip Sales Tax Calculator Number of Participants Subtotal Sales Tax pct flat Tip Amount pct flat exclude tax from tip round up payment Grand Total Total Bill Subtotal Sales Tax.

Tip Sales Tax Calculator Salecalc Com

Doordash Tax Calculator 2022 What Will I Owe How Bad Will It Hurt

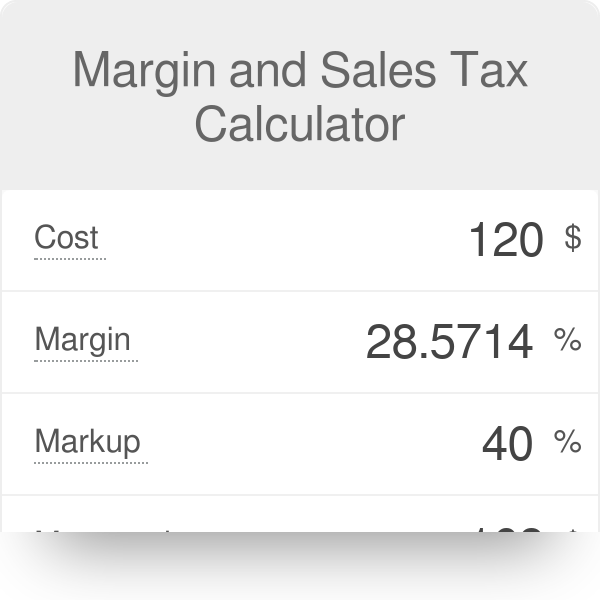

Casio How To Use Calculator Tax Calculations Youtube

Sales Tax Calculator Taxjar

Vermont Income Tax Calculator Smartasset

Sales Tax On Grocery Items Taxjar

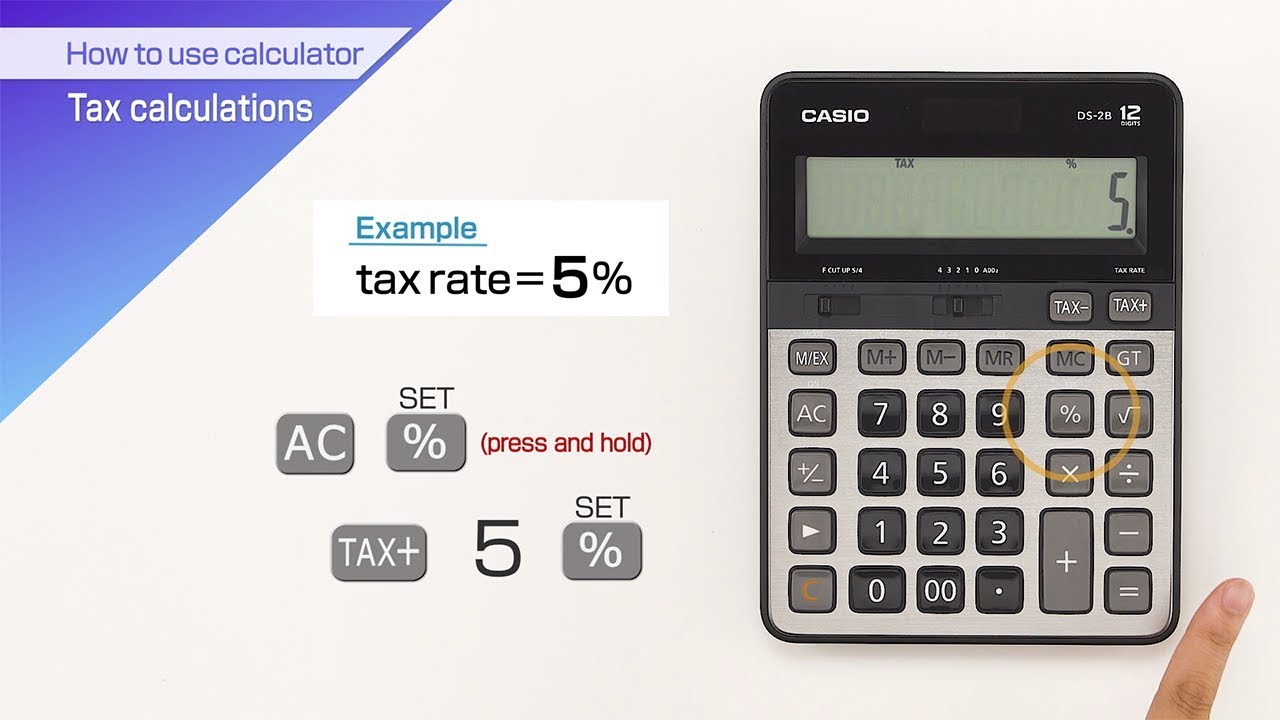

Download Income Tax Calculator Fy 2018 19 Excel Template Exceldatapro

Sales Tax Api Taxjar

Sales Tax Calculator

Sales Tax Calculator Taxjar

Sales Tax Calculator Taxjar

6 Sales Tax Calculator Template Tax Printables Sales Tax Tax

Lottery Tax Calculator

Bc Sales Tax Gst Pst Calculator 2022 Wowa Ca

What Is Sales Tax Nexus Learn All About Nexus

Sales Tax Calculator

Sales Tax Calculator